Rich Dad Poor Dad summary

Who is Robert Kiyosaki?

Welcome to this rich Dad Poor Dad summary. Today, Robert Kiyosaki has become one of the most influential mentors in the world in his field: Financial Intelligence.

But who is he and how did he get there?

Robert Kiyosaki was a young child born in 1947 and living in Hawaii who from a very young age had a special wish: To understand and raise money

Today Robert Kiyosaki is a businessman and entrepreneur with many hats. He is an entrepreneur in personal development, financial intelligence, businessman, investor and writer.

Rich Dad Poor Dad, what is this book about?

First of all, you should know that this book is a mix between a narrative and Robert’s autobiography. It teaches the 8 lessons of financial intelligence.

In order to clarify the situation let us first explain the title of this book: Rich Dad Poor Dad.

The main lessons to remember

Invest in yourself first

Invest in things that make you money rather than things that make you lose money.

Don’t work for money

Give to receive

Create your assets

Replace “I can’t do this” with “How could I do this”.

Understand the tax system to keep as much of your money as possible.

Take Action

Don’t be afraid to lose money

Believe in yourself

Teach others

Pay yourself first

RICH DAD POOR DAD SUMMARY CHAPTER ONE: RICH DAD, POOR DAD

The poor Dad

In fact, Robert Kiyosaki’s poor Dad was his own blood father, who had a very good situation in the eyes of the state. He was a school teacher in Hawaii and was really based on “job security”, i.e. going to school, getting an education and finding a permanent job, however he had an unconsidered fear of losing his state pension and being penniless (and that’s what happened later on…).

The rich Dad

On the other side, there was Robert’s rich Dad, not his real father, but more of a mentor to him, the person who taught him everything. Specifically, it was the father of a friend he met as a child who taught him the values of money and how to get rich. His rich Dad was not a salaried employee or working for the state, he had his own businesses, his own way of managing his money without expecting any help from the state.

RICH DAD POOR DAD SUMMARY CHAPTER TWO: THE RICH DON’T WORK FOR MONEY

The book begins simply with Robert’s youth as a young child looking to make money.

A partnership is formed

At the age of 9, he met one of his friends and decided to start his own association and make money to get rich. One evening when Robert’s father and his friend (the father of the second child) came home and stood in front of the two children and asked them what they were doing. Robert answered spontaneously: “We are making money”.

Despite a loud laugh, Robert’s “poor” father simply explained to Robert that it is not possible to create money this way that it is illegal.

But behind him, Kiyosaki’s rich father uttered a sentence: “Boys, you are poor only if you surrender, the most important thing is that you have taken action. Most people stick to words and dream of being rich, you have acted. I am very proud of you. I’ll say it again. Keep going and don’t give up. »

He then invited him to his home and told him that if he wanted to understand and know how to make money, he could explain it to him. “You just have to come and see me tomorrow morning at my office,” he told him. That’s what Robert was the next day. »

Once he arrived at his rich father’s house, the latter made him wait a long time before receiving him to finally welcome him and offer him a hard, boring and low-paying job.

The only purpose of these Saturday morning jobs was to live what all employees go through at work in order to evolve, understand, grow because working for a boss you will complain all the time and spend your time complaining about your salary, or look for a new job that pays better… These people don’t work for themselves or because they love their work but simply to pay the bills.

The first lesson

This was the first lesson Robert’s rich father taught him:

“The poor and the middle class work for money, the rich make the money work for them.

It was just a little sentence, just a little lesson, but it was so important to Robert, who had only known the perspective of his dad who struggled every month to pay his bills and was stressed about losing his state pension.

Simply put, this first part of the book clearly demonstrates that in order to change your lifestyle and become financially independent, you must first react to your situation and not let the market walk all over you. As his rich father used to say, “If you weren’t angry when I made you work for pennies an hour, I wouldn’t have been able to teach you financial intelligence.

Rich people don’t let themselves be taken advantage of! The poor are filled with unconscious fears, and fall into the trap of work, hoping that the money or the earnings from work will make their fear of not having any more money disappear, of ending up on the street or whatever…

But the real question to ask is

“Would finding a job be the best solution to eliminate this fear in the long run? “The answer is NO!

This little bit of sentence is also very interesting to develop in financial intelligence, wage-earning makes people earn only enough to pay the bills and survive in the moment, but when you think about it, do you really think it takes away the total fear of ending up on the street without money?

If your boss fires you tomorrow, what happens? If by the time you retire, the state decides to eliminate it, how will you live? Working until you are 90 years old? By exchanging your time for money?

According to Robert and his rich father, the worst trap in life is fear and desire, two strong emotions that can guide your thoughts if you are ignorant and do not master the keys to financial intelligence.

A job is really a short-term solution but never a long-term one.

Without going into too much detail, the first part of this book is there to illustrate the difference in vision between Robert’s two fathers, one attracted by fear, job security and the other who creates wealth by creating assets. In order to get out of the Rat-Race, you have to see what others don’t see…

RICH DAD POOR DAD SUMMARY CHAPTER THREE: WHY TEACH FINANCIAL LITERACY?

UNDERSTAND THE ABCS OF FINANCE

The second part of this book is more dedicated to understanding the ABC’s of finance and how to apply and teach it on a daily basis.

For Robert, we must teach financial intelligence in school, teach children how money works and how to create it. You’re going to say yes, but it’s complicated, it’s accounting, children will never understand…

You’re partly right, however, maybe if financial education is not a subject taught in class (just like courses on the brain, concentration…) it’s simply that these are tools and methods that influential people want to hide from us. Because if everyone mastered these tools, the system and the society that the world’s super-influents have built would collapse.

Simplifying things

“Yes, but how do you want to teach accounting to elementary school children?” Quite simply, as Robert Kiyosaki says in his book: by simplifying things. The idea is not to teach them all the basics of accounting, but to teach them what money is, how to make it and above all how to keep it or make it grow through pictures, counting cakes for example, marbles, everything that can interest them at a young age…

This is not the case nowadays, today if you go to school, you are simply taught to become a good employee, a good worker, but you are never taught how to manage your money, isn’t it a pity? Anyway… Let’s go back to our sheep and our book. Once Robert received the basics of financial intelligence from his rich father, we had to go deeper into the subject and understand the difference between assets and liabilities and what cash flow is…

The important points of the ABCs of finance

To summarize for the uninitiated, the important points of the ABC are:

A liability is something that costs you money.

An asset is something that earns you money.

Cash flow is the money you keep after all transactions for the month/year have been processed.

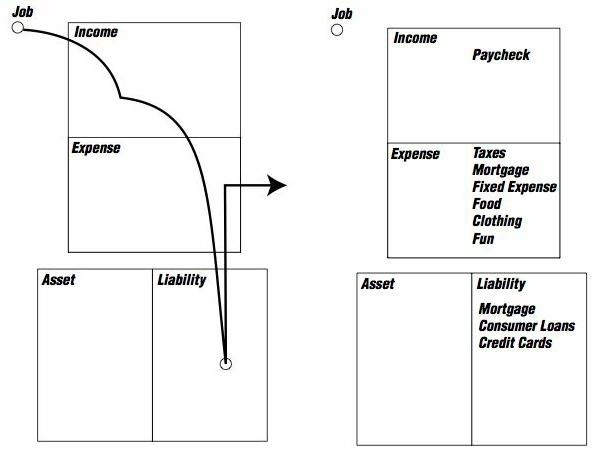

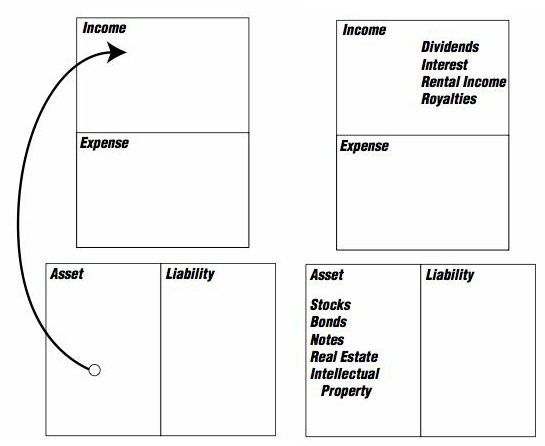

To illustrate this text, Robert used two examples of cash flow:

The cash flow of a person in the middle-class.

.. And the cash flow of a wealthy person:

As he also explains in his book, these diagrams are oversimplified, but have a huge difference.

The rich get richer

In the first case, the income (in this case the salaries) is invested in liabilities and the money comes out of your pocket. In the second case, the money is invested in assets that bring you money and the money goes into your pocket.

This is the key to enrichment, because the more your assets grow (a company, stock market vouchers…) the more money you will grow with them. And that’s why we can say that the rich get richer and the poor get poorer.

The poor get poorer

While in the other case if you buy a car or a plasma screen with all options, the last iPhone ( = liabilities ) their value will decrease year after year until they disappear completely and your investment will then be lost. All you will have to do is reinvest your money in these same products again and again…

Money doesn’t solve everything if

Another lesson learned from the ABCs of Finance is to understand that money doesn’t solve everything if you don’t know how to manage it, indeed, if a person who earns more money doesn’t know how money works, then it will work like this : The more his income will increase, the more his expenses will also increase. And this is one of the reasons why rich people can be ruined in a very short time even after having collected a colossal fortune! ( If I am not clear enough, please feel free to ask me for more details in the comments… )

The most important thing in life is not the total amount of money you make, but how much money you manage to keep.

Take care of your business and don’t be afraid to invest.

RICH DAD POOR DAD SUMMARY CHAPTER FOUR: MIND YOUR OWN BUSINESS

For the third part and to understand the power of investment, Robert gives us the example of Ray Croc the famous entrepreneur who turned Macdonald into a series of hamburger franchises and a real estate-based business.

In addition to this example, Robert presents you with a list of different asset classes in which he advises you to invest you and your children.

Businesses, in which you don’t work, otherwise it would become a job.

Stocks

Obligations

Mutual funds

Real estate that generates cash flow

Notes or IOUs

Royalties, copyrights resulting from intellectual property (music, books, patents, etc.).

Gold, silver… and anything else that has value and generates income.

Robert explains that at the time in his life when he was given this list of assets by his rich father, he was torn between his poor father telling him that he had to go to school and find a job to live a decent life without “problems” and his rich father telling him that he had to build up as many assets as possible.

When you want to “step out of the mold” or do things differently, people will judge you and not understand your decision. But if you think about it, later on those same people will say, “My God, he was lucky to get everything he has today, I wish I was in his place.

RICH DAD POOR DAD SUMMARY CHAPTER FIVE: THE HISTORY OF TAXES AND THE POWER OF CORPORATIONS

In the fourth part of his book, he now tells us about taxes and the history of taxes. Without going into details, here is what is highlighted in this part:

The rich are not taxed and the poor are overtaxed. But why are they overtaxed?

He explains in his book that originally there were no taxes and that taxes began to appear in order to finance the war effort at the beginning of the 18th century in England. Then these taxes became compulsory later in 1913 only for the wealthiest people !

Strange would you say ? Well no, the fact that these taxes were enforced only for the rich people pushed the people to exclude them and make them popular because it made equity profitable because it “punished the rich”.

But it has changed

However, over time, it is this same law today that ends up punishing the poor and the middle class. Because once the state managed to get a taste of money and use the finances of its people, its appetite grew and the money of the rich was no longer enough to provide for its needs, so taxes had to be imposed on the middle class and the poor too.

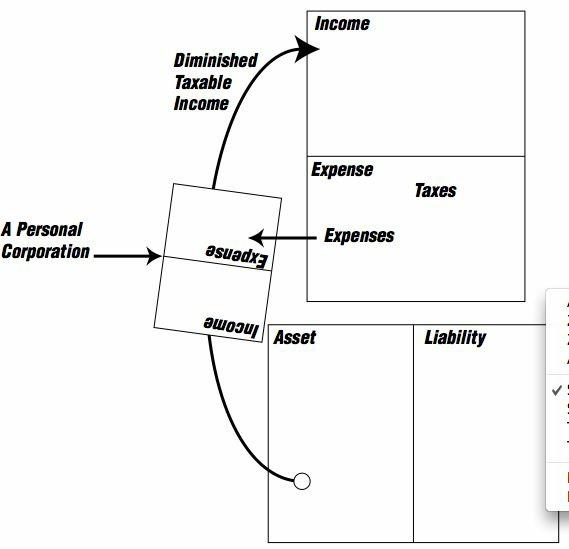

On top of all this, the rich managed, over time, to pay as little tax as possible, by creating businesses, setting up financial packages, getting tax breaks, investing their money in assets… To finally arrive at the situation you know today.

The situation today

The rich pay little or no taxes because they manage to avoid them, and taxes have a great impact on the middle class and the poor.

To refine and confirm this, Robert has put forward a diagram in his book that perfectly illustrates this example:

This diagram summarizes perfectly the fact that the rich pay little or no taxes because they manage to reinvest their money and reduce their taxation as much as possible: a Tax adviser has even become a profession.

Financial IQ

Later on, he teaches us that the financial IQ is based on 4 spheres:

The first one is accounting: What he calls financial literacy. The ABC’s of the FINANCIAL DOMAIN. Financial literacy is the ability to read and understand financial statements. This abilit

The second sphere is investing

The third sphere is understanding markets

The fourth sphere is the law

Concerning taxes and financial intelligence Robert Kiyosaki shows us the chronological order of a month according to 2 situations : People who own companies and people who work for companies.

People who own businesses :

1. Earn money

2. Spend

3. Pay taxes

People who work for companies :

1. Earn money

2. Pay taxes

3. Spend.

To cope with this “problem” Robert advises in his book to always pay yourself first.

RICH DAD POOR DAD SUMMARY CHAPTER SIX: THE RICH INVENT MONEY

HOW DO THE RICH GENERATE MONEY?

His fifth part refers to how the rich can generate money.

This is one of the most interesting parts of his book, which explains and demonstrates the power of financial intelligence.

As such, he explains in this part how to generate and keep money through financial intelligence while paying as little taxes as possible.

In this part he uses many examples because according to him the examples allow people:

To inspire people to learn more

Or to make them understand that everything becomes easy if the foundations are strong.

To show them that anyone can become rich

That there are multiple ways to achieve objectives

That it is not a complicated science

Two kinds of investors

As a bonus, he also talks to us in this part about financial investment and the different types of investors.

1. The first and most common type are people who buy a packaged investment. They call a retail outlet, such as a real estate company or a stockbroker or a financial planner, and they buy something. It could be a mutual fund, a REIT, a stock or a bond. It is a good clean and simple way of investing. An example would be a shopper who goes to a computer store and buys a computer right off the shelf.

2. The second type are investors who create investments. This investor usually assembles a deal, much like there are people who buy components of computers and put it together. It’s like customizing. I do not know the first thing about putting components of a computer together. But I do know how to put pieces of opportunities together, or know people who do.

RICH DAD POOR DAD SUMMARY CHAPTER SEVEN: WORK TO LEARN – DON’T WORK FOR MONEY

The sixth part is based on a simple fact: Work to learn, don’t work for money.

The idea here is to show you that you should choose and work in a field where you are going to learn. You have to choose a job that enriches you, not simply work for money.

His poor father instilled in him the value of work and specialization. “Robert, you have to specialize in one area to become an expert so that you can make more money,” while his rich father thought the complete opposite: “Learn little in many areas.”

Two different approaches

Specialization and generalization, these are two totally different approaches to the world and how to do things, but knowing a lot will make it easier to adapt and open your mind to attack other markets. While knowing a lot about a subject will make it easier to become a “good employee” or a good expert on that particular job.

However, for some reason, if this profession were to disappear, what would you be left with? A great knowledge of a trade or field that no longer exists?

You will also find in this part the example of a person wishing to become a successful author who interviews Robert Kiyosaki.

RICH DAD POOR DAD SUMMARY CHAPTER EIGHT: OVERCOMING OBSTACLES

At the end of his book, Robert shows us how to overcome obstacles and how to increase his fortune tenfold. I will summarize this in several steps.

THE OBSTACLES

First of all, he gives the 5 reasons why even the most educated people will not develop wealth according to him :

Fear (of losing property, of losing money…)

Cynicism

Laziness

Bad habits

Arrogance

He backs up these various reasons with striking details and examples that I will let you discover once again in this book, as the expression goes: “Leave to Caesar what is Caesar’s”, and a summary would not allow us to resume with precision the power of the examples that are cited in the book. But don’t worry, I will give you a link to access this book in audio, e-book and/or paper format just below.

RICH DAD POOR DAD SUMMARY CHAPTER NINE: GETTING STARTED

THE 10-STEP GUIDE TO GET STARTED

Need a greater-than-life reason: The power of the mind.

Choose daily : The power of choice – Invest in yourself!

Choose your friends wisely : The Power of Association

Master one formula and learn a new one: The Power to Learn Quickly

Pay Yourself First: The Power of Self-Discipline

Pay your brokers and those who make your money work for you – The power of advice and synergy

Give the Indian – The Power to Acquire Something for Free

Treat yourself to luxury with your assets only – The power to concentrate

The need for a hero, find a role model, find a mentor – The power of the myth

Teach and you will receive – The power to give

The 6 lessons of the book rich dad poor dad

The rich don’t work for money.

It is necessary to understand why and how to teach the ABC’s of finance in schools to be able to help children.

Always take care of your own business.

Understand the history of taxes and the power of business over its taxes.

Rich people generate and create money.

Work for money, don’t work for money.

The main lessons to remember

Invest in yourself first

Invest in things that make you money rather than things that make you lose money.

Don’t work for money

Give to receive

Create your assets

Replace “I can’t do this” with “How could I do this”.

Understand the tax system to keep as much of your money as possible.

Take Action

Don’t be afraid to lose money

Believe in yourself

Teach others

Pay yourself first

Thank you for reading this Rich Dad Poor Dad summary, people also read:

Never split the difference summary

Exactly what to say – The magic words for influence and impact

Start with why summary